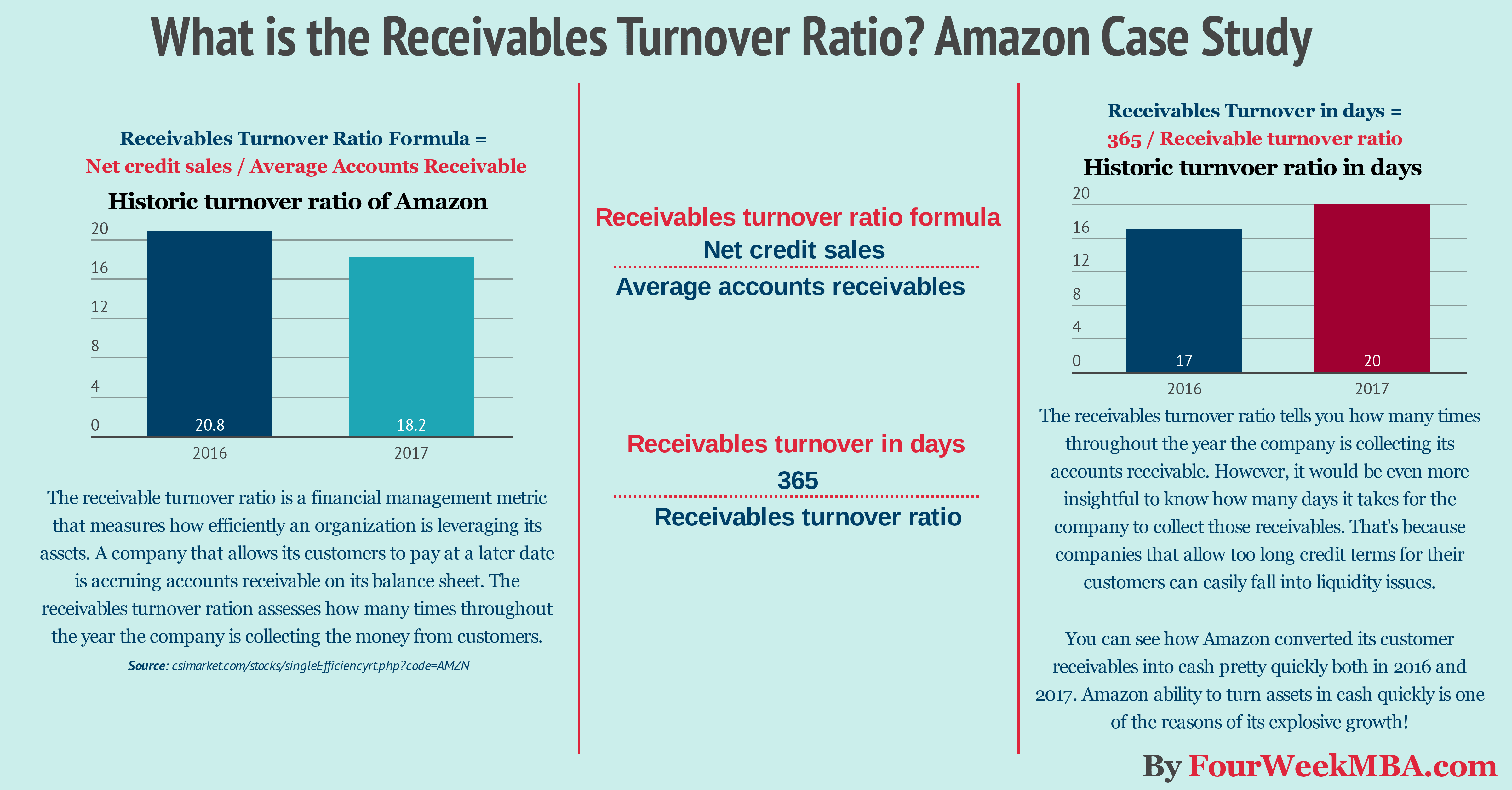

Average trade debtors or receivables = (Opening balance of debtors + Closing balance of debtors)/2 Net Credit Sales = Total or Gross Credit Sales (-) Sales return (-) Trade discount.Ģ. Net credit sale is the total sales made to the customers on a credit basis minus the sales returned by the customers and trade discounts, if any, allowed to them.

What is the debtors turnover ratio formula?ĭebtors turnover ratio is calculated with the help of the following formula:ĭebtors or Trade Receivables Turnover Ratio = Net Credit Sales / Average Trade Debtors or Receivablesġ. The debtors turnover ratio is also known as the trade receivables turnover ratio, a financial analysis tool to calculate the number of times the average debtors are converted into cash during the year. Due to the sale of goods on credit, there may be a delay in payments, and hence, the money receivable is known as accounts receivable. When sales are made in credit, the other party who owes money (to be paid later) is known as the debtor. In business, sales are made in cash as well as credit. Learn these aspects in detail in this article. In this regard, the account receivable turnover ratio measures the speed and efficiency of collecting money for the sales made in credit. Turnover ratios are also known as efficiency ratios, as these are calculated to determine the efficiency of managing and utilising current assets. Turnover ratios are calculated to determine how the number of assets and liabilities are created or exchanged in relation to a company's sales. Various ratios are calculated for analysis of financial information, among which turnover ratio is a crucial one.

0 kommentar(er)

0 kommentar(er)